Buy-in into pillar 3a from 01.01.2025

The Federal Council is implementing motion 19.3702 ‘Enabling purchases into pillar 3a’ by Councillor of States Erich Ettlin. The aim of the motion was to create the opportunity to make up for missed payments and thus strengthen private pension provision.

Pillar 3a is a tied pension plan that can only be withdrawn upon retirement. Payments into Pillar 3a can be deducted from taxable income and the assets already accumulated are not subject to income or wealth tax. Currently, the lump-sum benefit is taxed once at a reduced tax rate upon withdrawal. However, the future tax treatment of capital withdrawals from purchases is expected to be presented by the Federal Council at the end of January 2025 with the consultation draft «Review of tasks and subsidies».

The following applies from 1 January 2025:

- A buy-in of the last 10 years is possible if you are/were entitled to make a payment in the corresponding years (year of buy-in and year for which a subsequent payment is made) (income subject to AHV contributions in Switzerland).

- The maximum buy-in is the difference between the maximum amount at that time and the amount actually paid in.

- The ordinary annual contribution must be paid in full in the year in question (CHF 7,258.00 in 2025).

- The buy-in is limited to the small contribution (as at 2025 CHF 7,258.00). This means that employees with a second pillar can pay in a maximum of twice the small contribution per year, while employed persons without a second pillar can pay in a maximum of the small contribution after they have paid in the large contribution (as at 2025 20% of earned income max. CHF 36,288.00).

- A buy in is only possible retroactively for years beginning 2025 and letter, i.e., for the first time in 2026 for 2025.

The buy-in and the current annual contribution are fully deductible from taxable income.

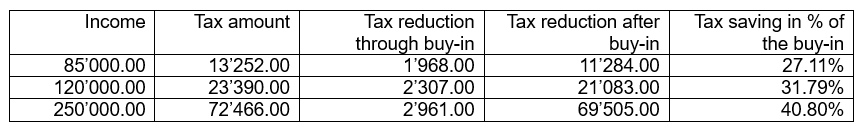

Specific calculation examples for the canton of Zurich

The examples are calculated for a single person with Roman Catholic church tax. A buy-in of CHF 7,258.00 has the following effect on the tax amount:

However, the retrospective buy-in can also be used for tax planning e.g., if there are high deductions in a year due to property maintenance costs or education costs, which already reduce the marginal tax rate.

Conclusion

A buy-in into pillar 3a makes sense to compensate for life situations in which the financial possibilities are lacking (e.g. studies, start of self-employment, family time, etc.). However, the purchase can also be used to save tax if there are already high deductions in a year due to property maintenance costs or further education costs, for example, which can reduce the marginal tax rate in the progression.

Value Solutions Treuhand und Unternehmensberatung AG | Hinterbergstrasse 17 | 6330 Cham

+41 (0)41 748 35 50 | Diese E-Mail-Adresse ist vor Spambots geschützt! Zur Anzeige muss JavaScript eingeschaltet sein!